At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What Should I Know About Going over a Credit Card Limit?

Going over a credit card limit can have some unfortunate consequences. It can involve large penalties or extra fines and fees, a transaction could instead be denied, and it may temporarily affect your credit score. Most people worry a lot about this last consequence, but it should be stated that accidentally going over the limit once is not likely to have a long term effect on your credit rating.

Credit card companies have numerous options they can exercise when a person tries to make an over the limit purchase. Usually, if the amount is very small, they won’t deny the purchase. This is especially true if the limit had not been reached prior to the purchase. A large purchase that goes over the credit card limit by a greater amount is likely be handled different.

If a customer has excellent credit, the card company might increase the limit. It is better to call the company and ask for an increase instead of waiting for their response. Alternately, the card company can simply refuse the transaction.

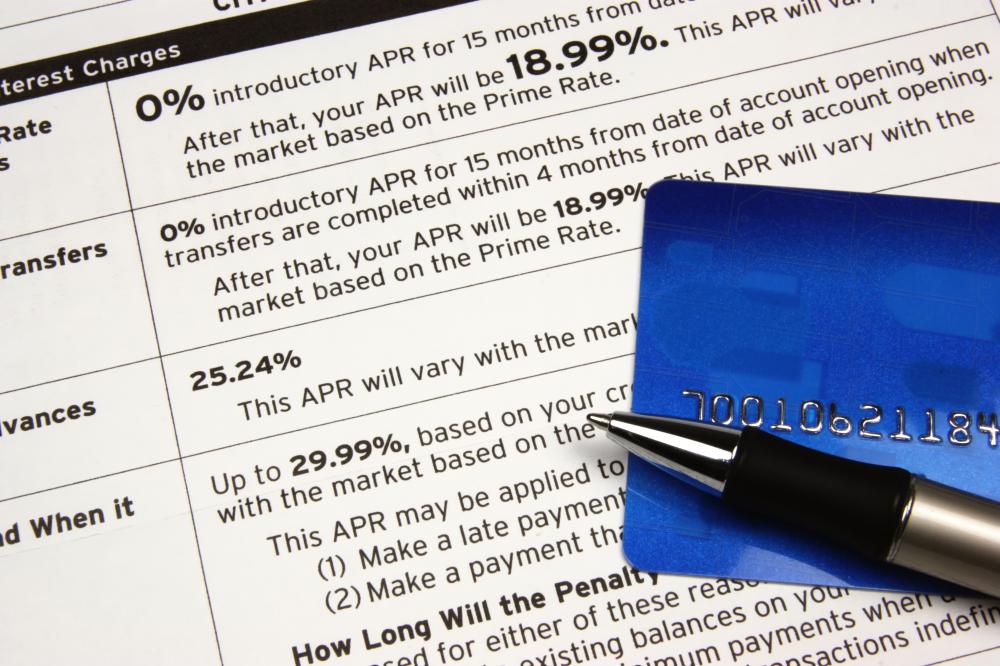

Another tactic is to allow the purchase but to charge extremely high fines. These penalties should be defined in each credit offer. The amount owed on over limit expenses is usually due immediately and customers may be charged a late fee for going over a credit card limit and not paying the overage amount right away. All in all, the combination of penalties and fees may be quite high if you exceed your limit.

Sometimes, credit card companies treat going over the limit as an excuse to raise interest rates. Alternately, they may charge additional interest on any over limit amounts. It’s wise to avoid this practice because of the potential fees involved.

As for your credit rating, the credit reporting agencies tend to evaluate how much credit is available to a person. When someone has $1,000 US Dollars (USD) of available credit and uses $900 USD, there is only 10% available credit. The credit rating reflects negatively when a person uses up most of his or her available credit, and obviously going over a credit card limit will show that the person does not have any available credit.

When a person can immediately rectify this situation, this report changes quickly. The credit report would only reflect this in the month it occurred. Constantly going over your credit card limit will mean this always shows up on your credit report, however. Consumer counselors recommend that consumers use no more than 30% of their available credit to maintain a good credit rating, and this will help keep purchases from exceeding credit limits.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

"@SurfNturf" - I agree that the department store cards carry very high interest rates. I wanted to say that many banks are also changing the minimum payment percentages because so many people have maxed out their credit cards.

I know that Chase changed its minimum payment from 1% to 2% and some people are even paying 5% of the total balance in some cases. While this may not seem like much if you have a balance of $25,000 those credit card payments can feel like a small mortgage.

Also most of the banks have upped their interest rates for late payers to up to 30% interest. So if you can pay down your debt you are better off because borrowing this money is getting more expensive.

I always look at how long it will take me to pay off the balance and that always keeps me from paying the minimum payment.

"@GreenWeaver" - I agree with you. This is why a lot of department stores always try to get you to open an account and offer you additional savings on your current purchases if you do.

They know that once you open the account you will more than likely buy more than you would have if you were paying cash and they earn about 24% in interest payments for those customers that carry balances.

The department store credit card APR is among the highest of all the credit cards out there. I do have a Macy’s account, but I only use it a few times a year and then I pay it off right away. I only use during Black Friday when the incentives are huge.

"@Cafe41" -I agree with you especially if something like this happens in mixed company. I wanted to say that when I had a student credit card in college, I found myself carrying a balance way beyond college and ended up maxing out my credit cards.

In fact my credit card balance was $9,000 which is when I had enough and paid down my credit card bill, and I now use my credit card sparingly and pay off my bills at the end of the month when I do.

I think that another good strategy to avoid overspending involves developing a budget and allocating a certain amount of money in cash for each category and placing the cash in the envelope.

This way if you designate your clothing allowance to be $200 for the month, once the envelope is empty you are done for that month.

This will force you to spend what you can afford to spend. There are many studies that show that when you use your bank credit card or any credit card for that matter you will tend to spend more because you are not held immediately accountable for your purchases as you are when you pay cash.

I always try to pay my credit card bill at the end of the month. I used run up balances but when you start to do that it can easy to get carried away and then you have a huge set of bills to pay that can overwhelm you.

It is also embarrassing if you are told that your credit card was declined because you were over your limit. This happened to a friend of mine and I was embarrassed for her.

The additional charges for exceeding your credit limit don't help either. It is really a bad situation all the way around.

Post your comments