At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What Is the Difference between an Invoice and a Receipt?

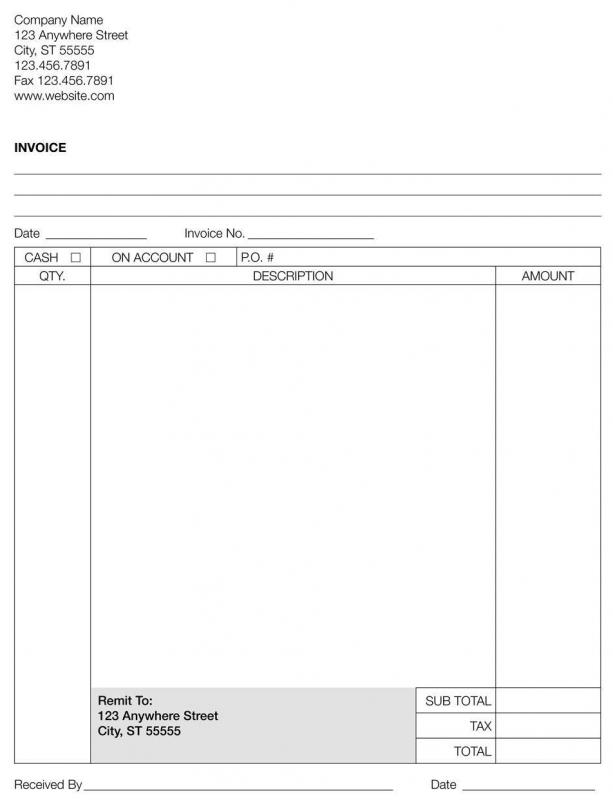

The major differences between an invoice and a receipt stem from when each type of document is provided during the purchasing process and the purpose for each document. An invoice is usually issued by the seller of a product or service to the person or company purchasing that item, usually once this item is transferred but before it is paid for. On the other hand, a receipt is issued by the seller to the buyer after the item has been paid for. While both of these documents are issued by the seller, the invoice is a request for payment while the receipt is a record of payment.

An invoice and a receipt are both typically issued by the seller of a product or a service to the buyer of that item, though each document is intended for a different purpose. Invoices are used as a means of documenting products or services provided by a seller to the buyer, and then requesting payment for that item. This is usually issued upon delivery of the ordered item, though an invoice can also be issued after an order is placed but prior to delivery.

The receipt is issued by the seller to the buyer of an item after payment is made for that item. It effectively acts as a proof of purchase for the buyer, so he or she can demonstrate that a product or service was legitimately purchased. This can also be used by a buyer to keep track of payments that have been received for various items. Both an invoice and a receipt can be used as part of a purchase cycle, to help the buyer and seller keep track of where they are in that cycle.

This difference in where an invoice and a receipt are issued within the time line of the purchase process is noteworthy. The importance of an invoice is based on the use of invoices for documenting sales prior to payment, allowing sellers to track outgoing products and indicating to buyers what products or services are incoming. This is important for properly tracking inventory on both sides of the purchasing process, and for buyers to keep track of payments that are pending. Receipts, on the other hand, allow buyers to track payments that have been made and make it easier for sellers to track what invoices have been paid and which ones are still pending.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

@ElizaBennett - That makes sense. But sometimes the receipt is not as detailed as the invoice. Then, both for tax purposes and for your own records, you might want to save them both together.

There are two other good reasons to save receipts: warranty and insurance. A lot of manufacturers require the orignal receipt in order to honor the warranty. Even some things that you don't think of as having a warranty can be returnable if they're defective. I once got my money back for a pair of shoes that wore out unacceptably fast!

Insurance companies also like to see receipts if you are filing a claim for theft or other kind of loss. I don't know if it's necessarily required, but it's a good idea to keep the receipts for big-ticket items like TVs.

It's worth noting that sales receipts, as opposed to invoices, are what you need to save for tax purposes. An invoice shows that you were *supposed* to pay, not that you did!

A receipt can be for other things than payment, of course - you might also get a receipt for a donation of money or items. Either way, hang on to it unless you want to get in trouble if you get audited!

Post your comments