At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is an International Money Order?

An international money order is similar in appearance and function to a regular money order. It is used across borders as a secure, prepaid form of payment. This method of payment usually is purchased at the buyer’s bank in the currency of the country he or she plans to visit. It is often more trusted than a personal check because the funds are guaranteed and identification is required to cash it. International money orders have drawbacks, however, including the potential for fraud, amount restrictions, and limited places of acceptance.

To obtain an international money order, the traveler must locate a bank or other organization that operates internationally. This organization needs to issue international money orders in the currency of the traveler’s intended country for it to be accepted there. The participating countries and policies differ from organization to organization. For example, the United States Postal Service (USPS) will not issue money orders worth more than $700 US Dollars (USD). In fact, the USPS limits some countries to $500 USD per international money order.

The purchase price of an international money order is usually a flat fee. In most cases, the recipient's bank also charges him or her a processing fee to cash it. These fees vary based on the receiving country. Depending on the jurisdiction in which the international money order was purchased, a service charge is usually applied six months to three years after the purchase date. International money orders normally do not have an expiration date, however.

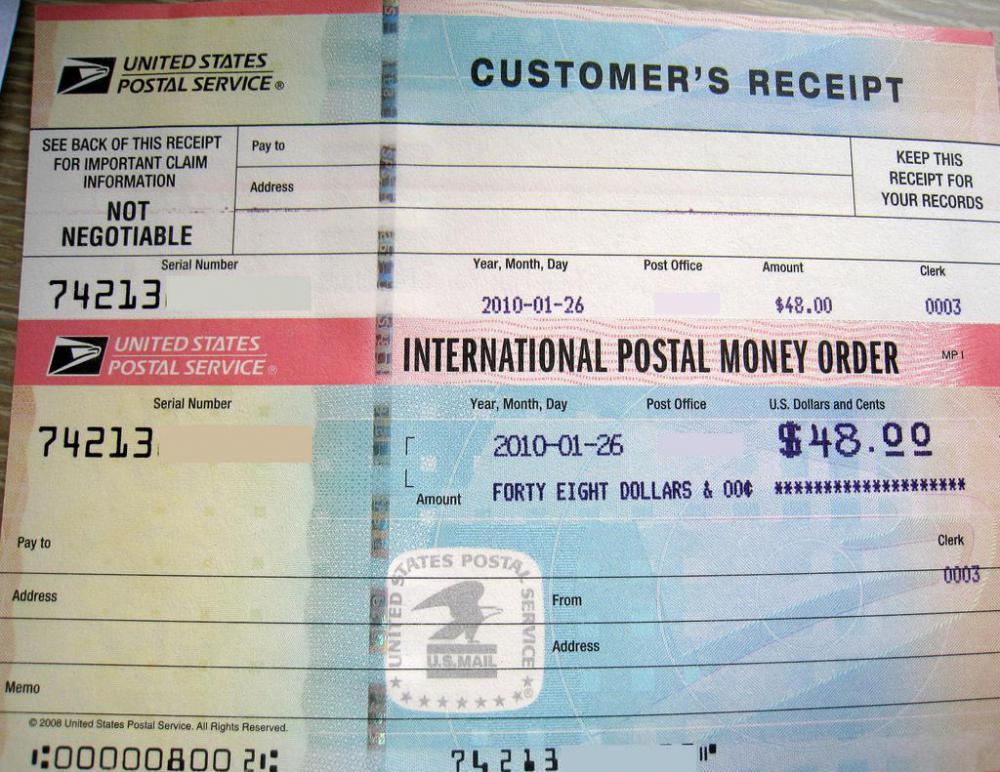

Like regular money orders, fake international money orders are sometimes used to scam sellers. The buyer sends the seller a fake money order to purchase goods or sends more money than asked for and requests money back. In both cases, the fake money order is eventually rejected by the seller’s bank. To prevent being taken by fraudulent buyers, sellers can familiarize themselves with the appearance and value restrictions of real international money orders. In addition, they can wait until their bank officially accepts the money, or not accept international money orders at all.

Most financial institutions that accept international money orders require them to meet certain standards. Being printed on pink and yellow paper and including the words “international postal money order” are common standards. In addition, each country usually has a standardized width and length for both domestic and international money orders. Even if all criteria are met, however, some banks may refuse to honor this form of payment.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments