At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is an Average Tax Rate?

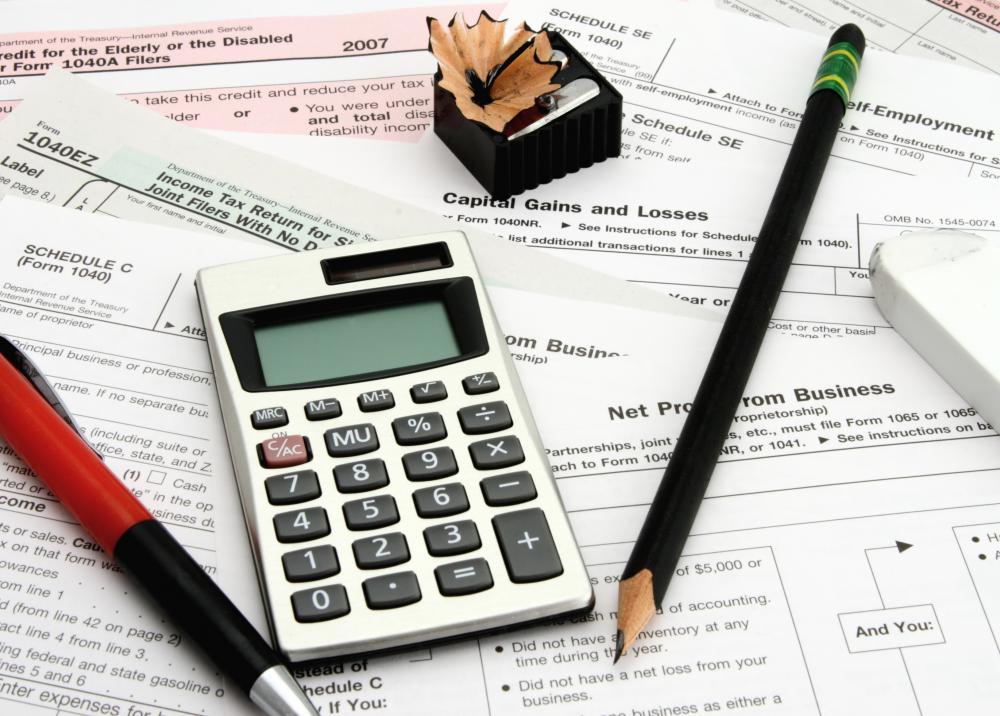

The average, or mean, tax rate of individuals and companies is the total tax burden assessed on personal incomes or wages. The average rate is usually calculated as a percentage using a mathematical formula. In the United States, the Internal Revenue Service (IRS) uses a progressive tax system for taxing citizens. As income rises, individuals must pay a higher tax rate on each dollar over a pre-determined limit. Each tax rate increase signals a rise in the marginal tax rates paid by individuals. The individual’s mean tax rate may be calculated by adding up each marginal tax rate and dividing it by the total number of marginal rates.

In 2009, the marginal tax rates for individuals were 10%, 15%, 25%, 28%, 33% and 35%. Each rate is assessed up to a certain dollar amount depending on the individual’s filing status and total taxable income. A U.S. taxpayer filing as a single individual with a total income of $65,000 would have an average tax rate of 16.7%. Here’s the calculation for this average rate: income $0-8,350 is taxed at 10%; income from $8,351-33,950 is taxed at 15%; and income from $33,951-82,250 is taxed at 25%. Therefore, the mean tax rate calculation is 10+15+25/3, or 16.7%.

Several variations may be used for individuals attempting to calculate their tax percentage liability. Each method takes different information or scenarios into account for the mathematical calculation. Two variations of the calculation are the effective average tax rate or the effective marginal tax rate.

The effective average rate calculation does not use the total taxable income for determining the average tax rate. This calculation may calculate the effective mean tax rate based on how the individual’s total income depending is earned, i.e. passive income, traditional wages or 1099 income.

The effective marginal tax rate is calculated for individuals with social security income or benefits that are phasing out, such as tax-delayed pension plans or retirement accounts. This income is separated out from normal income because it is money that does not accurately represent the individual’s current income made through jobs or standard or other standard wages.

Companies may calculate its average tax rate using a different method. Most businesses pay a variety of taxes, including income tax, property tax, payroll tax and sales or use taxes. Calculating the average tax rates depend on how many of these business taxes are included in the company’s calculation process. Using individual average tax calculations are typically more useful for companies attempting to plan for future tax liabilities.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

I don't think that we need to compare average tax rates of countries because each country is different and they have different reasons for tax levels.

Americans since the founding of this country have always been wary of high taxes. No US presidential candidate who argues for higher taxes can expect to win office. Low taxes are our national mantra and we do have one of the lowest average tax rates in the world. Belgium, Greece and Italy have some of the highest but they have their own reasons.

More than the rate of taxes, what's important is how effective taxes are. Some governments raise taxes to expand social programs while others do to pay national debts. And there can never be a government that doesn't take taxes from its citizens.

So instead of concentrating on the average tax rate, we should look at how effective taxes are in providing the services that the public wants and needs.

@fify-- We actually have a low average tax rate compared to European countries. Most countries, especially those with vast social programs, tax much more than this. I don't think we should complain, our tax rates are reasonable.

Isn't the average federal tax rate in the US too high?

I'm okay with tax rates increasing according to income. I think that's the right way to go about it but I think the percentage that tax rates start out with should be smaller.

Someone who has $0-8,350 income shouldn't be taxed 10%! This is annual income and is clearly at or close to the poverty line.

Post your comments