At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is a Voluntary Contribution?

Voluntary contributions are understood to be the amount of resources that are deposited into a retirement plan. Often, these employee contributions are identified as the portion of a salary or wages that an employee chooses to place into the plan. Depending on the structure of the plan, the employer may match the contributions up to a specified amount, or may include an employer contribution that is based on other criteria.

In general, the voluntary contribution is made on what is known as an after-tax basis. Essentially, this creates a situation where the employee can defer tax on any future earnings that may come about from the contributed amount. However, it is important to note that regulations regarding this construct of the voluntary contribution may not allow for this option. When that is the case, the voluntary contribution is understood to be a pre-tax contribution and will be subject to taxation when the employee begins to draw benefits from the retirement plan.

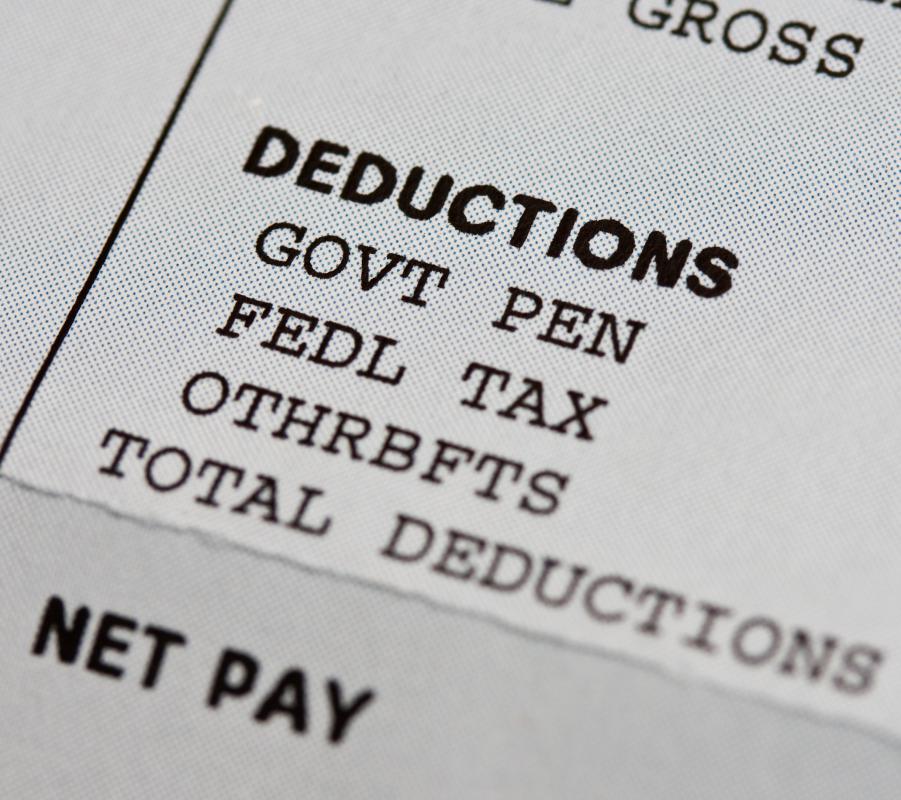

The main function of a voluntary contribution is to allow the employee to incrementally build a financial reserve that can be called upon later in life. Retirement plans vary a great deal from one employer to another. However, many of them will allow the employee to designate either a fixed amount or a percentage of his or her regular pay to automatically go into the retirement fund as an employee contribution.

This means that the employee never has to keep up with the task of contributing to the plan. A simple payroll deduction is done on behalf of the employee. For people who find it hard to save money, this approach can be an ideal way to create and build a nest egg for the future.

In the event that the voluntary contribution process does not allow for after-tax procedures, then the individual may be responsible for paying taxes on the proceeds from the retirement plan as they are received. This will depend on the total amount received from the plan in a calendar year, as well as the amount of income that is received from other sources during the same time period.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

VIP, or Voluntary Investment Program, is one of the vehicles one can use for saving money for retirement. The money set aside from a paycheck is tax deffered, meaning that at some point in the future taxes will have to be paid.

The age when you have to start withdrawing from the account and start paying taxes is 70 1/2. This is regardless whether you need the money or not. You have to figure out what is the minimum amount you have to withdraw from your differed account on a yearly basis.

Post your comments