At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is a Trust Deed?

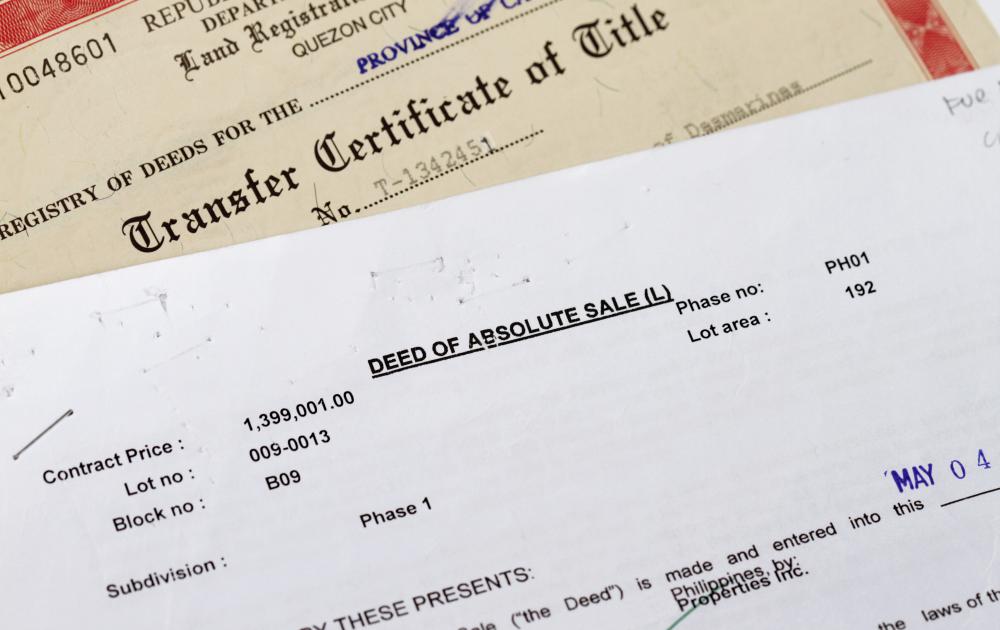

A trust deed transfers the title of property to a trustee responsible for holding it in trust until a loan is paid off. It’s often referred to as a deed of trust and sometimes a Potomac mortgage. The trustee must transfer the title to the borrower when the balance of the mortgage is paid off. It’s widely used in some regions in lieu of a mortgage, but in other areas the borrower receives the title to the property and takes out a mortgage. A trust deed is not a contract for deed, where the seller keeps the title until the buyer pays off the loan to the seller.

The three parties to a trust deed are the trustor, the trustee, and the beneficiary. The trustor is the borrower, who is entitled to possess the property. The beneficiary of the trust is the mortgage company. The trustee is the company that holds the title in trust for the trustor and the borrower. Its primary duty is to transfer the deed when it receives proof that the loan is paid in full. The secondary duty of the trustee is to sell the property if the borrower defaults on the loan and to distribute the proceeds sufficient to pay off the loan to the beneficiary.

The basic contents of a trust deed include a legal description of the real estate, the original loan amount, and acceleration clauses. It should also detail the mortgage terms as well as the legal recourses available to both parties if there is a legal dispute. Any prepayment penalty is often included in the trust deed, along with the monthly payment amount. The deed will also state that the trustee has the legal right to sell the property upon the trustor’s default on the loan.

The trustee can sell the property without going to court through a power of sale. The process is referred to as a foreclosure by power of sale. Even though a court does not oversee the proceedings, there are often laws that govern the sale, such as those that require a public notice of the foreclosure. In regions where mortgages are issued instead of a trust deed, it’s necessary for the lender to initiate foreclosure proceedings in court before it can foreclose on a property. It’s often risky for someone interested in purchasing a property that has been sold through a power of sale because there is more likely to be litigation over the title.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments