At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is a LBO?

An LBO, or leveraged buyout, is where someone buys a controlling interest of a company’s stocks by using leveraged finances. The LBO is used when an acquiring interest doesn’t wish to invest, or doesn’t have on hand, the amount of capital needed to actually buy a controlling interest in a target company. In order to finance the purchase, they therefore take out massive loans, using the assets of the company they will be acquiring as collateral against their debt. They then generally liquidate the company they’ve purchased, pay off the loans, and pocket the profit.

Generally the amount of leverage used in an LBO is high, but not excessively so. The average percentage of total purchase price made up of debt is generally around 60%, but in some cases it may be as high as 95%. These cases tend to only occur when the expectation of profit is almost assured, when the borrowing group is strongly trusted, and when the profit to be made is quite high.

The first LBO was likely in 1955, when McLean Industries borrowed $7 million US Dollars (USD) to buy Waterman Steamship Corporation for $49 million USD. After the company was acquired, $20 million USD of Waterman Steamship Corporation’s assets were sold off in order to pay back the borrowed money. Small-scale examples of the LBO continued through the 1950s and into the 1960s, when they began to grow somewhat. From the early LBO grew the use of holding companies that were publicly traded as a way to buy up investment in other assets, a tactic used to great effect by the great financiers of the 1960s, including Victor Posner and Warren Buffett.

In the 1980s, the LBO grew in popularity, with more than $250 billion USD worth of buyouts taking place in that decade. It was largely provoked by a purchase in 1982 by William Simon of Gibson Greetings for $80 million USD, of which something in excess of 95% of the investment capital was leveraged. Just over a year later, the company had an initial public offering (IPO) worth more than $290 million USD, netting Simon more than $65 million USD in profit.

It was during this period that the so-called corporate raiding LBO took the stage. This type of LBO generally used a hostile takeover to buyout the target company, rather than negotiating a sale of their own free will. After the sale, the acquiring group would often strip the company of its assets, or split it into its constituent parts and sell each part off for a profit. This was also referred to as scorched-earth investing, as buyers would swoop in, take a relatively-healthy or somewhat ailing company, and carve it into pieces for an immediate profit.

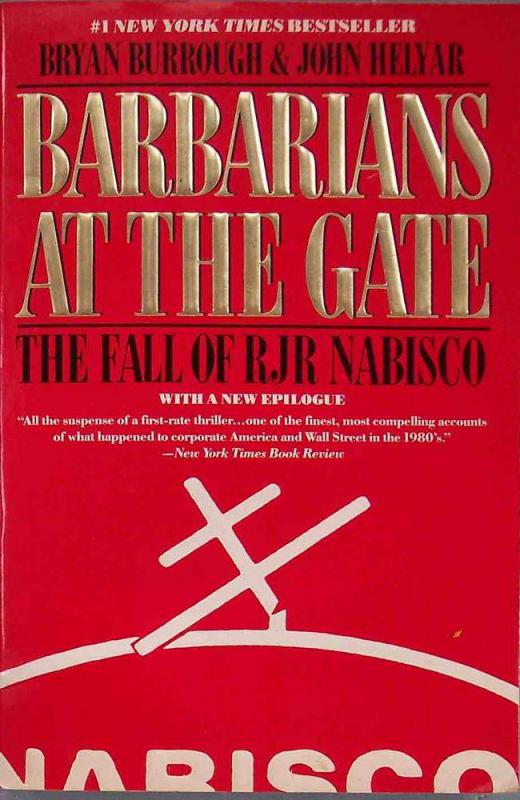

The largest LBO of the 1980s, and the largest ever once values are adjusted for inflation, was the takeover of RJR Nabisco by KKR. After submitting a final bid of $109 a share, well over the initial offering of $75 a share by Shearson Lehman Hutton, KKR won a fierce bidding war to acquire Nabisco. This LBO was chronicled in the seminal book on both the LBO and hostile takeover, Barbarians at the Gate.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

Various categories of LBO

Post your comments