At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is a Deed of Trust?

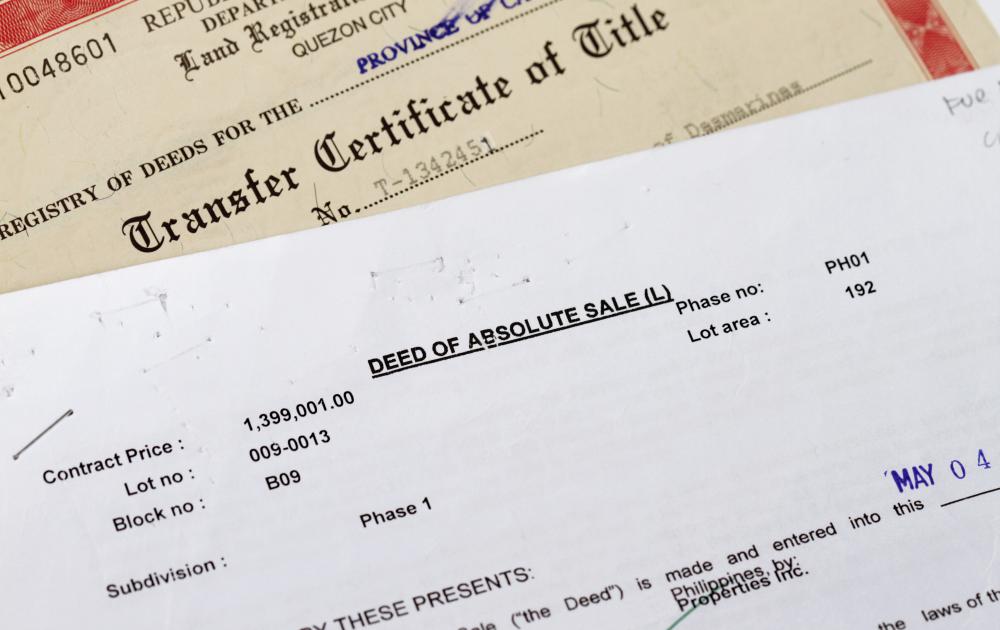

In the United States, a deed of trust (or a trust deed) is an evidence of debt. It is the record of transfer of the title of a property to a third party to hold as security. It is a common method of financing your real estate property in several states. It is also the recorded document of title in the public records.

A deed of trust instrument identifies the legal description of the property, the borrower and lender, the loan amount, the loan inception and maturity dates. It also specifies late fees, prepayment penalties, adjustable or fixed interest rates and any legal procedures or provisions and requirements.

While most states use a mortgage, states like California use a deed of trust. This deed establishes a trustee as holding title to the property until the obligation is paid in full. In other words, there is a three party system: the purchaser of the property who is applying for the loan, the lender, and the trustee, who holds the trust deed in good faith for the lender and borrower.

Often a title company is assigned as trustee. They will hold the document as security for the mortgage or loan company. When the property is paid off, the title company will release the deed of trust in the form of a Deed of Release. At that point, the title is transferred to the purchaser, marked “paid in full.”

The title company is a silent vehicle in most transactions and acts independently from the purchaser or the lender. Only if there is a default on the loan will they take an active roll. At that point, the trustee will file a Notice of Default, giving the borrower 90 days to pay any back payments and penalties. At the end of that time, and a 21-day newspaper publication notice, the trustee has the power to sell the property and use the proceeds to pay off the lender.

While a deed of trust establishes the title to the trustee, the purchaser still holds the rights and privileges of the property. The main difference between a mortgage and a trust deed is that this document allows the trustee to foreclose on the property directly. They do not need to take the default to court.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

When you have a large amount of money to pay back, you might need to hire a third party to help negotiate a deed of trust or a similar document with your lenders. However, it can be really helpful in getting that money back without added drama.

The deed of trust sort of sounds like a more official for of an IOU. However, it seems like a good idea for someone who owes or is owed a large sum of money. This way, both parties know what is expected and the borrower cannot skip out on the debt, while the lender cannot suddenly expect all of the money at once before it is due.

Post your comments