At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is a Credit Card Cash Advance?

A credit card cash advance is cash which can be accessed with a credit card. To get a cash advance, a credit card user swipes the card at an ATM, enters a personal identity number (PIN), and receives cash in exchange. Most consumer advocates strongly urge against getting a credit card cash advance, and people who need a source of ready cash should definitely consider alternative sources, as credit card cash advances come with a number of hidden strings.

Usually, a credit card statement will inform the consumer how much credit he or she has “available for cash.” This is typically a percentage of the overall credit limit which can vary, depending on the consumer's credit score and other factors. To access the cash, the consumer needs to get a PIN from the credit card company. Many credit card companies also use “credit card checks,” which work exactly like a credit card cash advance.

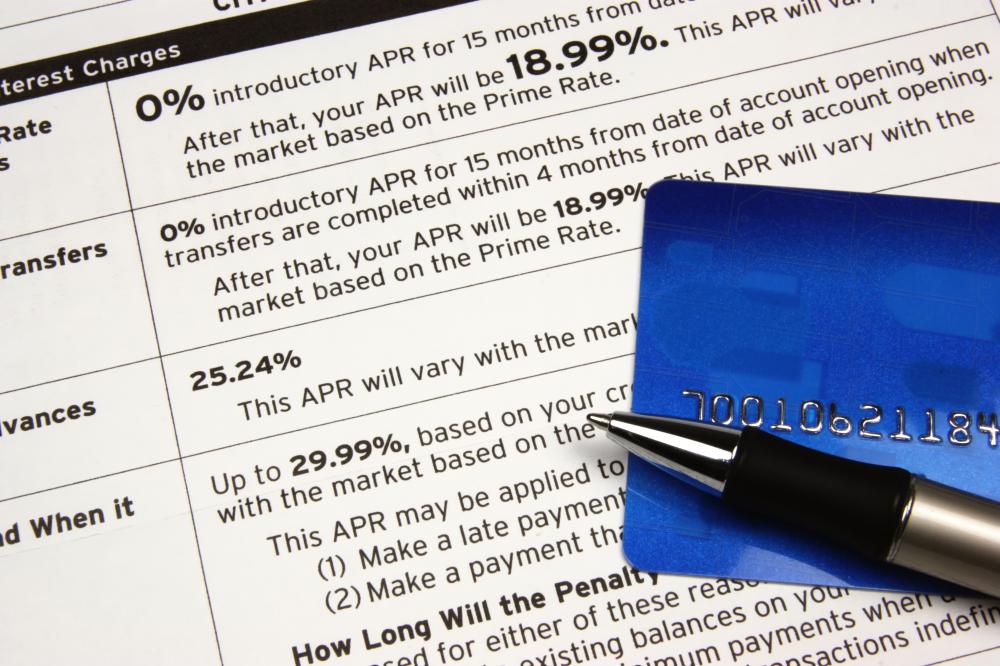

There are a number of problems with the credit card cash advance. The first is that the cash advance is usually accompanied by a high fee, and the interest rate on cash advances is higher than that for credit card purchases. Furthermore, many credit cards apply payments to lower interest balances first, which means that someone who is carrying a balance will rack up interest charges fast with a cash advance until the card is paid off.

Often, the clock starts ticking immediately with a credit card cash advance. The cardholder has no grace period such as that available with purchases, with interest charges accruing as soon as the cash is taken out. In addition, the user may be charged an additional fee for ATM access from both the credit card company and the owner of the ATM, causing fees to accumulate quite rapidly. It is very easy to get into trouble with a credit card cash advance because of the high costs associated with it.

Most people take out a credit card cash advance because they need cash in a hurry, but they should remember that using a credit card to get cash is a way of spending cash which they do not have. If money is desperately needed for something, it is better to take out a personal loan from a bank, or to use a home equity line of credit. Borrowing from friends or parents is also an option which is preferable to using a credit card for cash.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

Oasis11- This can work for a small business as well in order to avoid a merchant credit card cash advance.

Avoiding business credit card cash advance by structuring a budget and sticking to it should reduce or eliminate the need to use the cash advance on a credit card.

If you think about it most credit cards APR or annual percentage yield is in the high teens to almost 20% interest. Reward cards usually have even higher annual percentage yields because this is how the banks offset the cost of the rewards.

Cupcake15-It is far better to have a cash budget in which you determine how much you will spend each month and then you cash a check for the exact amount and you place your predetermined budgetary amounts in various envelopes.

For example, if you allocated $400 for food and $1,000 for the mortgage then you would get an envelope and write food on the outside and then place the $400 inside. You continue this way until you have completed your entire budget.

This way once the money is gone in the envelope then you can not spend anymore money. The money in the envelopes should be used only for the expenditures listed in order for the budget to truly work. This will keep you from credit card cash advance locations.

A cash advance on credit card is very expensive. Charges from 3 to 5% are charged for any immediate withdrawals.

That is basically a credit card cash advance fee of $3 to $5 per for every hundred dollars that you borrow is not uncommon. A cash advance from credit cards should really be used as a withdrawal of last resort.

Post your comments