At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is a Cash Card?

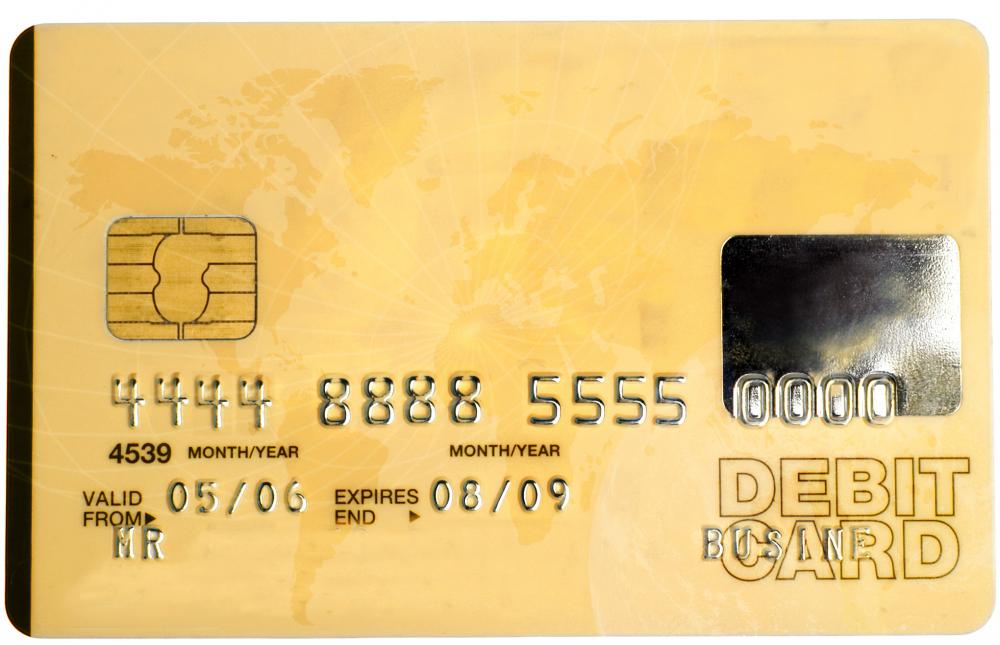

A cash card can have several different definitions. One of these is that the card is used only at bank ATM machines to draw on available account funds. This is usually distinguished from a debit card that can also be used to make purchases. Alternately, the term may simply be synonymous with "debit card," or it can be a prepaid card that allows people to either make purchases or withdraw cash.

Most people today have a debit card, which they may call a cash card. In certain cases, banks won’t issue the standard point of sale debit card to customers. This is sometimes the case for accounts issued to minors. In these instances, the banks still have to give the account holder a way to withdraw money at times when the bank might not be open. They can issue a cash card, providing the account holder with access to funds. Not all banks observe this rule and it really depends upon the region.

The cash card that is also a debit card can be used in ATMs to withdraw money from an account. Many banks have deals with a variety of ATM providers, so people can withdraw funds from their account at private ATM locations or through the ATMs of other banks. Additionally, most debit cards can now be used just like a credit card in retail locations. People can use the cash card to buy groceries, pay for gas, stay at a hotel, or shop at the mall. Many people love the convenience of these cards and won’t obtain a bank account that doesn’t offer one.

One variation is the prepaid debit card, which allows a person spending rights to the amount of the prepayment. This may have a credit card company insignia on it, which means it can be used anywhere that a charge card is accepted, and people may be able to add more to their debit card balance, if they wish. It may also be possible to withdraw the cash amount of the card by using an ATM, though this varies.

Prepaid cards can be specific to a store or collection of stores. For example, a Costco® cash card is used only at Costco’s store or for online purchase from the company. This type of cash can’t be refunded and the money is dedicated to Costco® spending only. There are numerous vendor-specific cash card types, and they are essentially like gift certificates. People can buy pre-priced amounts for different types of vendors at places like grocery stores, or they may be able to determine the exact amount of their prepayment by buying a card directly from the vendor/retailer.

These last cards are the most limited because they do mean people will be restricted to using the cash card at a specific location. If interest is in providing a card with greater flexibility in spending, people might instead buy a pre-loaded general credit card. This definitely increases spending options.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

I remember when the ATM card you received when you opened your bank account was the only card option available. Back then I used the ATM cash card to get cash when I needed a few dollars and then I had a credit card that I got via a mail offer. Today, the only card I need is the debit cash card. I can use it like a credit card and an ATM card.

Because of bad credit or slow credit, there are a large number of people who cannot get traditional credit cards, and not everyone has a checking account either. Prepaid cash cards offer a way for these people to pay their bills with the convenience that people with good credit, credit cards and checking accounts enjoy.

I like to shop online. In the past, I have used my regular credit cards, but I began to worry about using my credit cards and debit cards online because I thought someone might get access to them and run up a large bill or empty my accounts.

However, with cash cards that I purchase from the store, I can buy whatever I want through the Internet or over the phone and I'm not concerned about anyone getting access to by personal cards.

Post your comments