At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is a 1099 Sale?

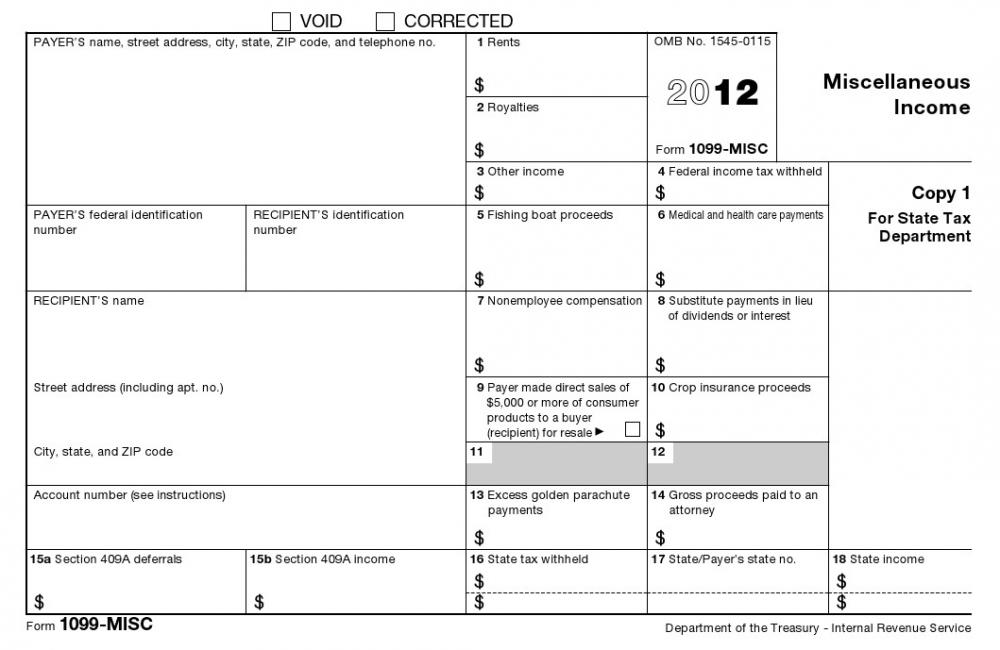

A 1099 sale is a sale or transfer of stock or other securities which must be reported to the Internal Revenue Service (IRS). In this case, an IRS Form 1099-B will be issued by the broker who handled the transaction, to the person who sold the stock. Most securities transactions fall under the category of a 1099 sale. A Form 1099 will be issued by the broker regardless of whether the person’s account had a net gain or loss in a given tax year.

The most common situation in which a 1099 sale will take place is when someone, using their personal account with a brokerage firm, buys and then at some point sells a stock. When this sale takes place, it is recorded, and at the end of the tax year, the 1099-B is sent to the account owner. This form lists every sale of stock that occurred in the previous year, and includes details such as the name of the company, its stock ticker symbol, the number of shares purchased or sold, the total purchase amount, and the proceeds from the sale.

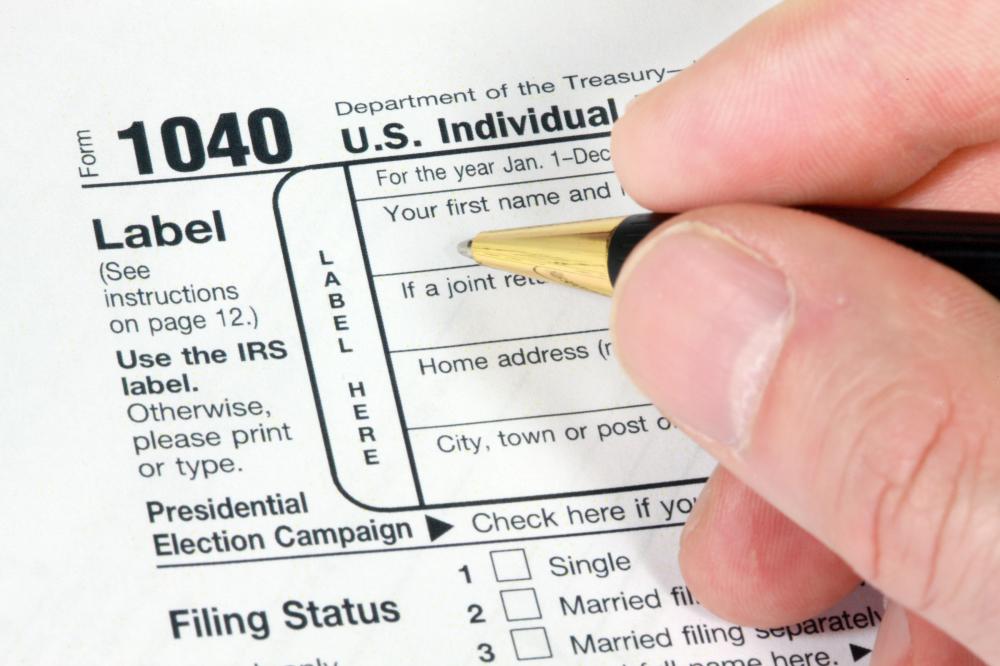

Each of these transactions is then entered into the correct place on IRS Form 1040, Schedule D. This can be a daunting task for someone who makes a living by trading securities, as the details of each 1099 sale must be recorded individually on the tax return. Another common form that a 1099 sale can take is the sale of stock that was purchased as part of an employee stock purchase program (ESPP).

Proceeds from stock that came from an ESPP are slightly more complicated to deal with, and may be reported in different ways, even though this type of sale is still considered a 1099 sale. This is because the stock is purchased at a discount through the ESPP. For example, someone might pay only $1750 US Dollars (USD) to acquire stock that is worth $2,000 USD. Because the $250 USD difference is considered compensation, it is reported on a Form W-2 and sent to the IRS on a Form 1040 tax return.

The shares bought through an ESPP must be held for a certain time in order to avoid having to report the “compensation” consisting of the discount, as well as the capital gain or loss. If the qualifying time period has not passed before the sale of the stock, the compensation must be reported even if the sale resulted in a capital loss.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

I worked in a non-profit clinic x 5 years, while working there the clinic paid part of a tuition for continuing education. The money was paid for one year. I stopped working in March the following year and I'm paying monthly payments. However I received from them a 1099 for the total amount that they paid. I would like to know if in this situation, is the 1099 legal?

Thank you

Maria

Post your comments