At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What are the Steps for Checkbook Reconciliation?

There are multiple steps for checkbook reconciliation, but they can all be boiled down to one essential task: keeping complete track of a checking account's deposits and withdrawals to ensure that bank records and the account holder's records match. Checkbook reconciliation is also known as balancing one's checkbook. Balancing one's checkbook is a useful tool for keeping accurate track of all expenditures and deposits.

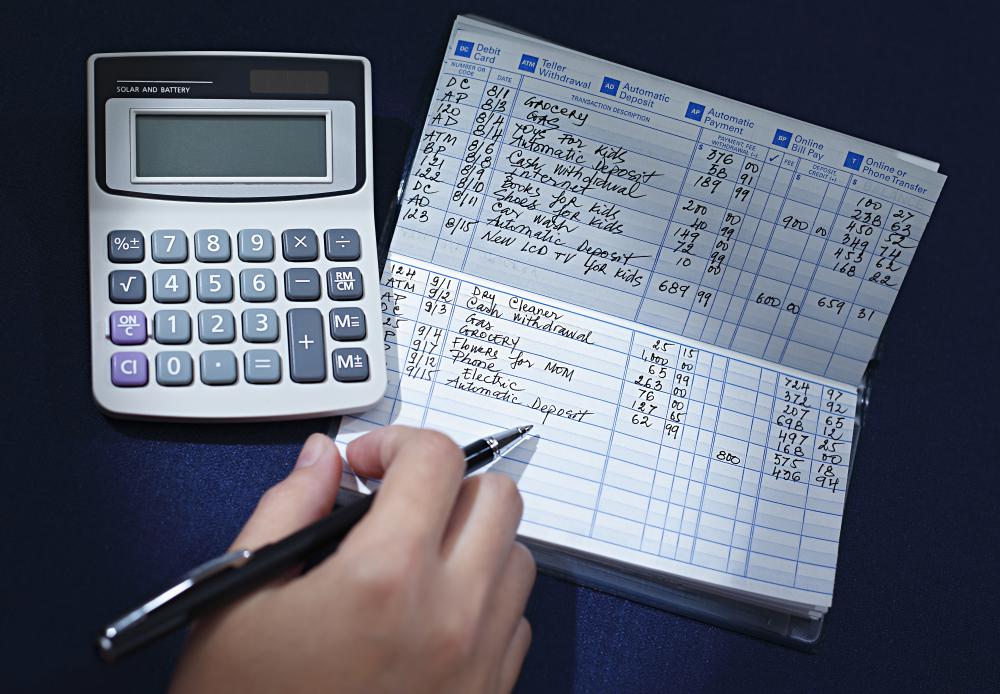

The first step to checkbook reconciliation is to choose something upon which to record all deposits and transactions. Most people choose to use the checkbook register provided by banks in every checkbook. This is simply a set of sheets in the front or back of one's checkbook that contains a series of blank lines. Using the register, one can record any deposit, transaction, and earned interest; there are also spaces provided to record individual check numbers. Such data could, of course, be easily compiled elsewhere—in a notebook or some other writing pad. If a pen and paper aren't one's preference, computers offer tantalizing alternatives, such as various types of spreadsheet software that provides ways to balance a checkbook. Many of these programs have built-in calculators which automatically tally numbers as well.

Once a checkbook reconciliation accounting tool is decided upon, the individual should record all deposits and transactions made in chronological order. Each transaction or deposit should be recorded on a separate line. Deposits include any money added to a checking account, which includes any interest earned. Transactions include all debit card purchases, withdrawals, money orders, and checks written. Many find it easiest to record transactions and deposits as they go, for the dual purpose of keeping track of their account balance at all times and to avoid sitting for an exhausting amount of time at the end of the month, sorting through old receipts.

At the end of each month, the bank will release a statement of the checking account's recent activity. This is called a bank statement, and it will include all deposits, withdrawals, and transactions made on the account. If the account holder has been dutifully recording all activity on the account throughout the month, it should only take a few minutes to sit down with the bank statement and ensure that individual account records match up with the bank’s. This is a uniquely important step for checkbook reconciliation, as it gives the individual a chance to catch any accounting errors made by the bank.

Online banking has changed the way many individuals approach checkbook reconciliation. Banks today allow individuals to log in to their banking accounts and monitor up-to-date activity. If individuals are dutiful about logging in regularly to monitor their account activity, online banking can be a strong ally for fiscal responsibility. It isn't necessarily, however, a complete replacement for manually balancing a checkbook. Like any other financial tool, checkbook reconciliation and online banking are only as good as the individual's commitment to use them.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

I guess I'm one of those people who treats the bank's online balance as the gospel truth. Most of the time when I do a checkbook reconciliation, I find I'm wrong and the bank reconciliation statement is exactly right. But there have been times when a paper check has gotten lost or the recipient forgot to deposit it. I'm always glad I have a personal check register that keeps track of all the checks I've written.

There was one time when I trusted the bank's monthly statement and a check I wrote three months earlier suddenly appeared. It was a substantial amount, and it almost wiped out my entire balance. Fortunately, I was in the habit of setting aside a little cushion if I thought a check might be floating around out there.

I have to admit I don't perform a checkbook reconciliation nearly as often as I once did. Almost all of my current bills are paid through electronic drafts or online payments these days. I rarely write paper checks anymore. A lot of places won't even accept checks as payment, either.

However, I'm glad I did do a manual checkbook reconciliation last month, because I caught a serious accounting error by the bank. I checked my current balance through my bank's online banking service and it was lower than what my personal check registered showed. I got a bank reconciliation statement and discovered that the bank got two numbers reversed on a deposit. That made my balance $47 lower, and I would have bounced a check if I hadn't caught it.

Post your comments