At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What are the Different Types of Independent Contractor Taxes?

A person who is an employee of a business or corporation pays taxes when his employer deducts money from each payroll check before the employee receives it. An independent contractor, who is considered by the U.S. Internal Revenue Service (IRS) to be self-employed, is responsible for paying his own taxes to the IRS. These independent contractor taxes generally include income tax and a self-employment tax that combines Social Security and Medicare taxes. While these are basically the same taxes standard employees pay, the method of paying them is quite different.

Independent contractor taxes are calculated based on either a net loss number or a net profit number. These numbers are calculated by subtracting the total amount of business expenses a self-employed person had in a year from the total amount of money the business generated for the year. If the expenses were more than the income, the difference is referred to as a net loss. If the income was more than the expenses, the difference is called a net profit. Income tax is paid based on the net profit.

The self-employment tax takes a portion of the independent contractor’s income and puts it into the Social Security and Medicare programs. Those programs’ fees are paid before a typical employee ever sees his paycheck. In a normal employer-employee situation, the employee would pay half of his owed Social Security and Medicare taxes and his employer would pay the other half. Independent contractors are required by the IRS to pay both of these portions, making the tax unique to those who are self-employed.

Independent contractor taxes are typically required to be paid quarterly, as opposed to annually, as regular employment taxes are. This means a self-employed person will make four separate tax payments to the IRS throughout the year, based on his estimated earnings at each point. If 90 percent of the total amount a person will owe for a year isn’t paid by the final estimated payment in January, the IRS can assess penalties on top of collecting the rest of the money owed.

Independent contractor taxes are eligible for many of the same deductions for which regular employees are eligible, in addition to some unique ones. For example, independent contractors can deduct 100 percent of their health insurance costs throughout a year. This is because, in a regular employee-employer situation, the employer typically provides health insurance. Independent contractors are also allowed to deduct expenses for things such as home offices and the gas needed to run a vehicle used for a business.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

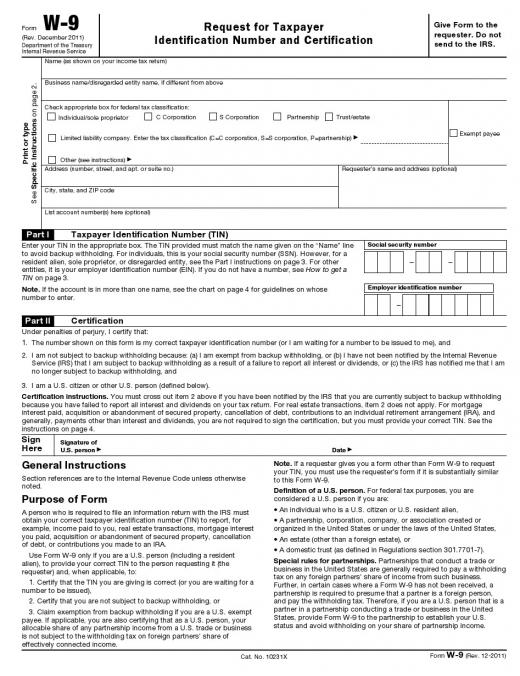

Is there a w9 amount that is low enough to not be reported?

If you are receiving public assistance, and you received a 1099, will it show up when they search your social number? At end of the year they started direct deposit, so will it pop up I was working somewhere?

What's the limit that can be filed on a 1099 without supporting documents?

Post your comments