At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What Are the Different Types of Credit Card Affiliate Programs?

There are various types of credit card affiliate programs a person may use to make money as an affiliate marketer. Among the most common are those that involve attracting applicants who can then apply for several different credit cards. Another type of credit card affiliate program involves offering just one type of credit card or cards from a single credit card company. Additionally, credit card affiliate programs often differ based on how commissions are paid.

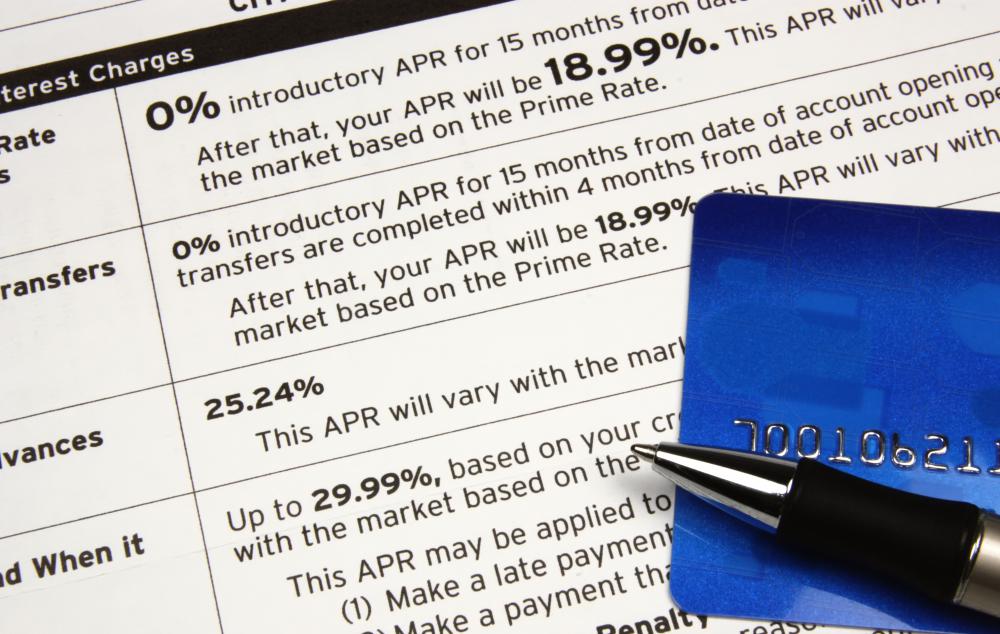

One type of credit card affiliate program is one in which the affiliate marketer acts as a credit card broker for several different types of credit cards. Through the affiliate marketer, a person can apply for several different types of credit cards rather than just one. The number of credit cards offered this way tends to vary, and some credit card affiliate programs include search engines and comparison charts through which a person can compare credit card features, application requirements, and interest rates.

An affiliate marketer may also find some credit card affiliate programs that focus on one type of credit card. Instead of working on attracting applicants who then have to choose between various credit cards or use a matching tool to select one, an affiliate marketer will work to attract applicants for a single credit card or a single credit card company.

Sometimes credit card affiliate programs differ in terms of the types of credit card applicants who have the best chance of gaining approval. For example, some credit card affiliate programs may be designed for offering credit cards to people who have bad credit versus traditional credit card accounts. Others may be intended for those who have good credit and a good chance of securing credit cards with the most attractive rates and terms. Focusing on a specific type of credit card applicant may, in some cases, make attracting applicants easier.

The various credit card affiliate programs also differ when it comes to affiliate marketer commissions. In some cases, an affiliate marketer receives a commission each time he gets a person to complete a credit card application that results in an approval. Others, however, are not approval based. They typically provide commissions each time an affiliate marketer has someone complete a credit card application, regardless of whether or not he is approved for the card. Usually, an individual earns a higher commission through the programs that only pay when the applicant is approved.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments