At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

Is There a Medicare Deduction?

When filing tax a return in the United States, a person has a choice of using a standard deduction, which is based on age and filing status, or of itemizing deductions, whichever is most advantageous. Taxpayers who itemize and are on Medicare may be entitled to a Medicare deduction. The place to deduct these premiums is on the IRS Schedule A.

Medicare insurance has three plans. Medicare A is automatically given to people who are on Social Security and to federal retirees who paid Medicare tax. Because there is no out-of-pocket expense, there is nothing to deduct for this plan. The only exception is for federal retirees who are not covered by social security, yet have opted to purchase Medicare A. Since they are actually paying for this insurance premium, it may be deducted as medical insurance.

Medicare B is optional supplemental medical insurance, and Medicare D is an optional prescription plan. Social security recipients may choose to purchase these as a deduction from their benefits, and the amount paid will be shown on Form SSA-1099. Since both plans are paid for by the consumer and are health insurance, they qualify for a Medicare deduction as part of the medical deduction.

Medical deductions are limited, however, to only that amount which exceeds 7.5 percent of the taxpayer’s adjusted gross income (AGI). For example, if a person’s AGI is $30,000 US Dollars (USD), then 7.5% of that equals $2250 USD. If his combined medical deductions equal $3000 USD, he will be able to deduct a total of $750 USD in medical expenses on Schedule A.

Many people who should qualify for a Medicare deduction on their tax returns do not claim it because they are unaware of everything that qualifies as a medical deduction. All other medical, dental, and vision insurance premiums are also deductible, not just Medicare insurance, as well as a portion of the premiums paid for a long-term care policy. In addition to the normal medical co-pays, expenses paid to eye doctors, for corrective lenses or surgery, diagnostic tests, dental costs, and chiropractic care are also deductible. Transportation costs to and from doctors, hospitals, or rehabilitative counseling sessions should be included as well.

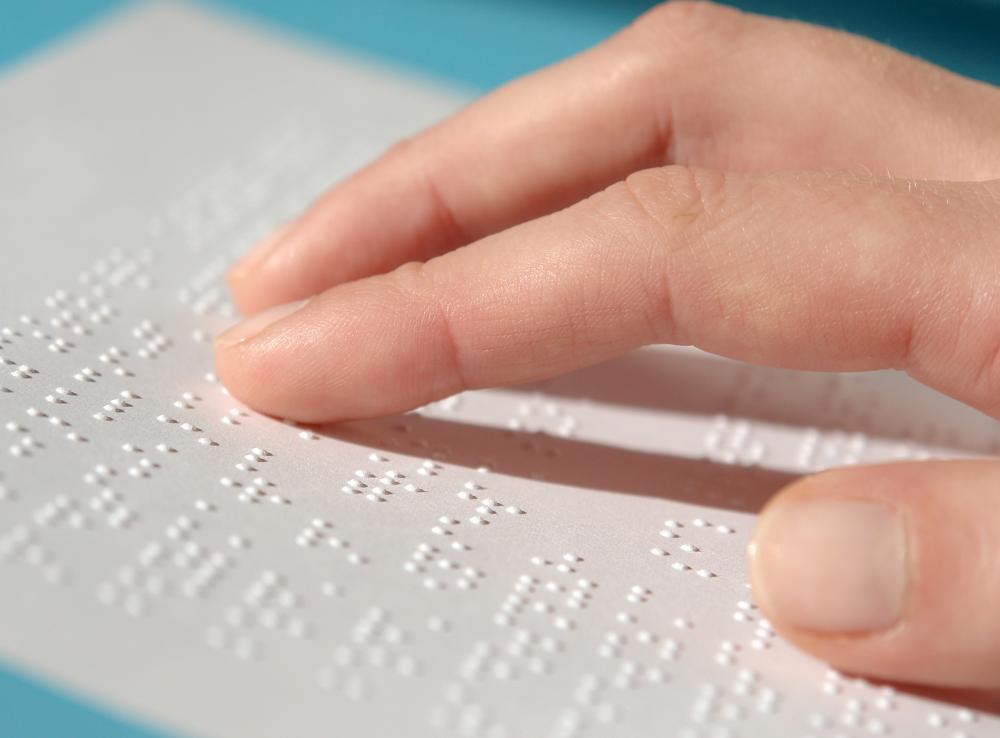

Other unique medical costs that may be deductible include acquiring and maintaining service animals, acupuncture, treatment for alcohol or drug addiction, home care, and a portion of the cost of Braille books and magazines. Certain capital improvements made to a home to accommodate a disability may also be deducted. Taxpayers with disabled dependent care expenses may choose to include them with the medical expenses or use the dependent care credit, whichever is the most beneficial.

While there is no universal Medicare deduction, these costs should not be overlooked when computing the total medical expenses for the year. Careful records and an understanding of what qualifies as a medical expense will assist a taxpayer in maximizing his deductions.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments