At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

How do I Choose the Best Balance Transfer Credit Card?

A Balance transfer is an excellent way for a consumer to save money. This option is offered by credit card companies in an attempt to pull customers away from their competitors. The best balance transfer credit card is one that offers free interest for an extended period. This is basically free credit for the consumer for a limited time.

Today there are many types of credit cards available for consumers. Each credit card typically has a specific interest rate, credit limit, and yearly maintenance cost. Choosing the best balance transfer credit card depends on the available credit and interest rate of the new credit card. This savings is easily calculated by comparing the interest rate of the current credit card to the rate of the new card.

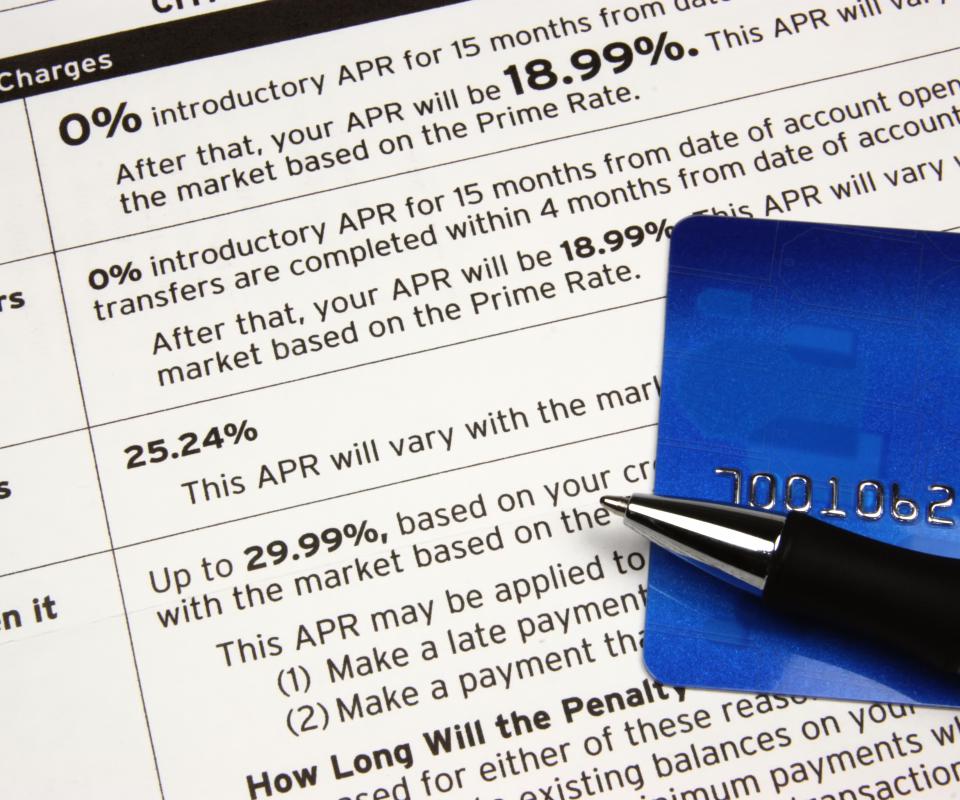

Most balance transfer interest rate programs are limited in time. These programs typically spike the interest after a predetermined introduction period. When selecting a balance transfer credit card it is important to read the fine print. Many times a balance transfer credit card will charge an exorbitant interest rate after the program introduction period has completed.

A balance transfer fee is a charge that is taxed on the consumer for the balance transfer service. Most credit card companies waive this fee for the first few balance transfers. A balance transfer fee is typically based on a percentage of the dollars transferred. If a consumer wants to use the balance transfer option, it is typically better to do that while it is freely offered.

Many credit card companies charge a yearly maintenance fee. Paying a yearly fee is not the best option. This charge is sometimes not necessary for most consumers with good credit.

Individuals with bad credit are typically penalized with higher interest rates and fees. These charges are based on the risk of potential write-offs. Customers with bad credit ratings are better served to improve their credit score before applying for a balance transfer credit card.

Credit card companies charge interest on revolving debt. This is debt that is carried for more then 30 days. Paying a credit card in full within 30 days is typically interest free. This type of management approach can save consumers considerable money.

A fixed interest rate credit card is the best option for consumers. This type of credit card interest rate remains unchanged. A balance transfer credit card that is based on a competitive fixed interest rate is the best choice.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments